Electronic Checks: Definition, Benefits and How e-checks work?

What is E-Check Payment System?

Definition of E-Check

Security Features of Electronic Check

- Authentication

- Public key cryptography

- Digital signatures

- Encryptions

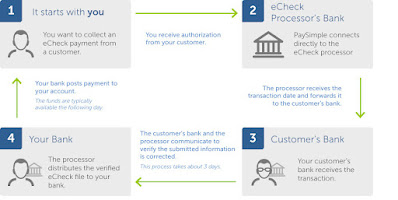

How does an Electronic Check work?

Benefits of e-checks

- Improved cash flow

- Eliminate bank processing fees

- Reduced deposit preparation time

- Online reporting through a secured web-based network

- Reduced accounting requirements

- Flexibles solution to check to process

- Funds available to merchant within two banking days

- Check verification and authorization through a nationwide database

- Large national negative database

- ID-based check fraud protection available

- Positive scoring database

- Merchants selected check acceptance controls

How to process an E-Check payment?

Request Authorization:

The business needs to gain authorization from the customer to make the transaction. The authorization can be gained via an online payment form and signed order form.

Payment Set Up:

After the authorization, the business inputs the payment information into the online payment processing software. If it is a recurring payment, this information also includes the details of the recurring schedule.

Finalize and Submit

Once payment information is properly entered into the software, the business clicks "Save" or "Submit" and starts the ACH transaction process.

Payment Confirmation

The payment is automatically withdrawn from the customer's bank account and after that, the online software sends a payment receipt to the customer. And now, the payment itself is deposited into the business's bank account.

Also Read :

What is EDI (Electronic Data Interchange)?

References and Sources

https://www.investopedia.com/terms/e/electroniccheck.asp

https://www.linkedin.com/pulse/how-echeck-work-arun-kumar

https://paysimple.com/blog/how-do-echecks-work

https://payment.ninja/payments-digest/echecks-guide-to-understanding-how-electronic-checks-work